Memphis Medical District Investment Fund

American Cities Health Social Investment Practice

Small businesses opening. More housing options and affordable places to call home. Upgraded streetscapes. New transit options.

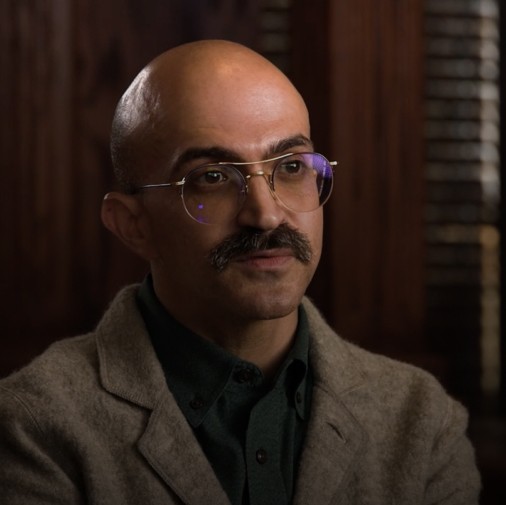

These are a few of the signs of the rapidly increasing economic activity in an area spanning more than a half dozen neighborhoods just north and east of downtown Memphis that together make up the Memphis Medical District.

This flurry of economic activity is no coincidence, but rather evidence of years of new partnerships, heightened collaboration and an intentional focus on community engagement alongside an infusion of capital, leading to a new era of rapid and inclusive development.

Read on to learn how a band of dedicated Memphians and their organizations, including Kresge’s partners the Memphis Medical District Collaborative and Pathway Lending, are working together to reshape how development in their city gets done.

In 2014, eight medical and educational institutions with footprints in the Memphis Medical District, in collaboration with Hyde Family Foundation, jointly hired a consulting firm, U3 Advisors, to design and help implement an “anchor strategy” to redirect the area’s massive economic resources and holdings into a more inclusive and vibrant district with a cohesive community development strategy behind it.

What they knew going in was that the District was Memphis’s largest employment center, but more than 95% of the employees and students who worked and studied there lived elsewhere.

Through this, a new nonprofit, the Memphis Medical District Collaborative (MMDC), was born. It’s charge: begin to change this dynamic. Kresge’s first grant to MMDC followed in 2016 to support a market analysis of the district.

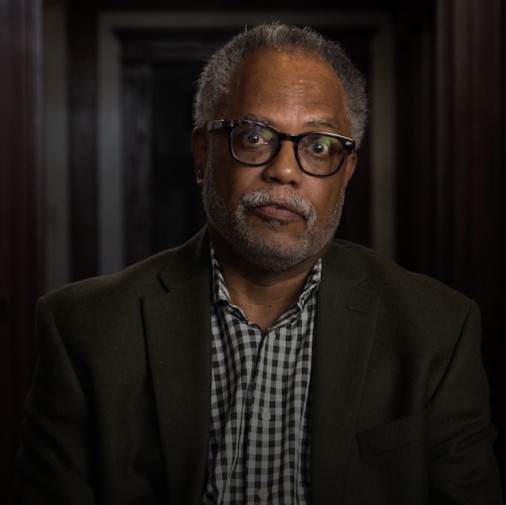

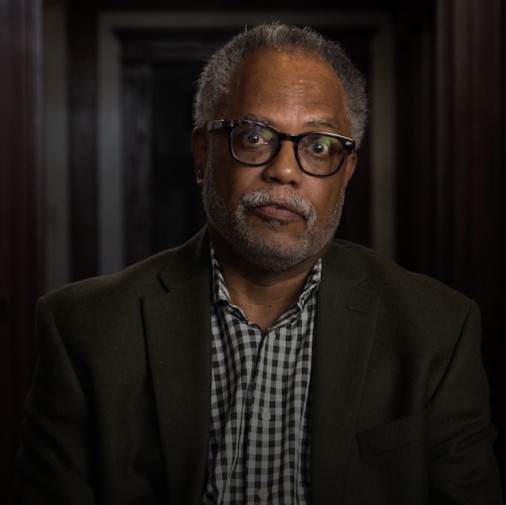

We couldn’t get appraised values for as-built or completed values. They weren’t just any comparables in the neighborhood.

- Hank Helton, Pathway Lending, Chief Stakeholder Officer

Two studies released in early 2017 determined the Memphis Medical District could support an additional 197,300 square feet of retail and restaurant development and accommodate up to 2,600 new residential units.

So why weren’t developers looking at this area as a place where development made sense?

But while more development was clearly needed, the team wanted to ensure that it built on the history and culture of the neighborhood and people who already called the District home. It was essential that any future economic development activity benefited those very people.

The Collaborative received Kresge support via a $75,000 grant to train small-scale real estate developers via boot camps and workshops, to ready them for what was coming next. The goal: to diversify the stable of ready-to-go developers, including woman-identifying real estate pros and developers of color. This program has led to at least 10 development projects that are either in pre-development or under construction.

Kresge, via another grant in 2017, also supported MMDC to conduct community engagement work centered on organizing and building resident capacity in neighborhoods north of Poplar and to establish a connected network of resident-led organizations across Medical District neighborhoods to strengthen resident representation in the decision-making process. This culminated in more than 900 individual connections in just one year in the North Poplar neighborhood alone.

Longtime residents of the District neighborhoods, like Tanja Mitchell, a resident of Uptown, feel this intentionally – that development is happening not around them but for them and with them.

The Collaborative received Kresge support via a $75,000 grant to train small-scale real estate developers via boot camps and workshops, to ready them for what was coming next. The goal: to diversify the stable of ready-to-go developers, including woman-identifying real estate pros and developers of color. This program has led to at least 10 development projects that are either in pre-development or under construction.

Meanwhile, Kresge’s Social Investment Practice brought together banks and other funders to form a transformational fund to invest into the district. The team had experience originating a similar investment fund that spurred a major uptick in development in Detroit’s Midtown neighborhood.

The Medical Memphis District Investment Fund launched officially in 2021 with $30 million. Pathway Lending, a Nashville-based CDFI, houses the fund, which is capitalized with $10 million each from Regions Bank, First Horizon Bank and Truist Bank, all backed by a $6 million guarantee from Kresge. Hyde Family Foundation provided operating support.

Kresge grant support allowed MMDC to hire its first Director of Real Estate, Ben Schulman, whose job is to cultivate community-serving projects. With this infusion of patient capital, a new era of development in the District began.

MMDC also houses a separate pre-development fund, backed by a $1 million Kresge program-related investment loan. Its goal is to issue smaller loans for site acquisition, environmental remediation and due diligence activities, especially to emerging or minority-led development teams. Kresge’s grantmaking support includes $450,000 for MMDC to grow, operate and provide seed grants.

In 2021-22, MMDC deployed 32 pre-development and 12 improvement grants for small and emerging businesses and development teams. Since July 2020, almost 50% grant recipients identify as minority and/or women-led.

Since the fund’s launch, development activity has galloped into high speed. The growth and energy and change in the District is palpable, and both longtime residents and newcomers feel the neighborhood blossoming into something new and exciting.

Raneem Imam, a social media strategist and musician, moved to the District in 2021 and has been evangelizing it to her friends ever since.

Below, see a tour of key sites in the District, as of May 2023. Below that, keep scrolling, to explore three projects underway.

757 Court

Located in the heart of the District, a 3-story mixed-use project at 757 Court will activate a vacant corner near another booming development, Orleans Station.

Photo: Rendering provided 757 Court Investments, LLC

It will feature a mixed-used site including 49 residential one-bedrooms, which are hard to find in the District, and 1,800 square feet of retail space.

Photo: Rendering provided 757 Court Investments, LLC

Aimed at bringing students into the District, 20% of the units will be held at affordable rates.

Photo: Rendering provided 757 Court Investments, LLC

The Greyhound

At 525 Main St., partners are working through the design phase of an adaptive reuse project of the former Old Greyhound bus terminal. The project preserves historic building stock but also includes new construction on a vacant lot south of the building.

Photo: Current view of the property

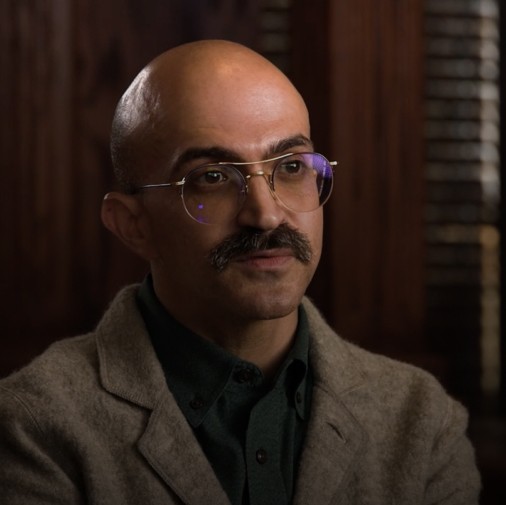

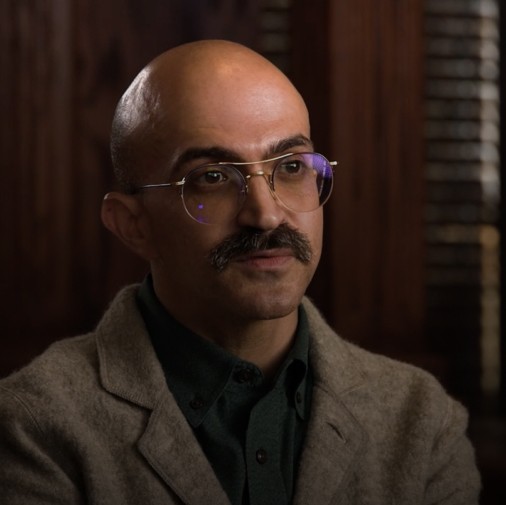

The Greyhound project is led by a diverse team from November 6 Investments. Total development cost is $34 million.

Photo: Partners Gabe Velasquez (left), Susannah Herring and Bill Ganus (right) and completed the mix of capital with a $2.25 million loan from Pathway Lending.

Photo: Project rendering

Orleans Station

The furthest along project to date is Orleans Station, where a diverse group of developers are trying to create a 24/7 neighborhood where a 10-acre, vacant educational property once stood. The team includes Turley Co., UTHSC, and ComCap Partners, a prominent African-American development and financing firm in the Southeast.

Photo: Current view of the development

It’s a mixed-use development in the truest sense. Retail and restaurants mixed with “third spaces” and homes. The low-rise, high-density design intends to bring an urban fabric feel — but on a human scale.

Photo: by Connor Ryan of a recent Orleans Station event

When fully complete, it will have 372 apartments, 16,000 square feet of commercial space and a plaza. Development cost is $66 million.

Drone photo by Connor Ryan

Ben Colar owns and operates two businesses nearby: Baby Grand, a creative consultancy, and Inkwell, a bustling high-end cocktail bar across the street from Orleans Station. As a Black mixologist, his goal with Inkwell is to make his community, and everyone who steps in the door, feel included in the craft cocktail scene.

Photo: MMDC helped him identify a space for Baby Grand, coordinate financing to open Inkwell (right), and access other supports

What’s Next

Through December 2022, more than $7 million of the $30 million Memphis Medical District Investment Fund dollars had been deployed. Another $7 million was in the pipeline to be dispersed. The full pipeline includes another $9 million of potential projects.

More Memphians are beginning to call the Medical District home. They stay there after work to eat, play, and unwind. They are enjoying a more beautiful and vibrant setting – public art, activated public spaces with dance parties in The Ravine, food trucks at BLANK, and more density all around.

The team of developers, community change agents, and small business owners is sparking a new era of inclusive community development. It is a beautifully diverse and culture-laden example, and one that is uniquely Memphis.

Now + Then Stories

Now + Then American Cities

Kresge’s deep commitment to working in Detroit inspires new place-based practice.

Now + Then Health

A founding area of support refines its strategy to community health, health equity.

Now + Then Social Investment Practice

The 2008 crisis sparks an expansion of Kresge’s toolset.